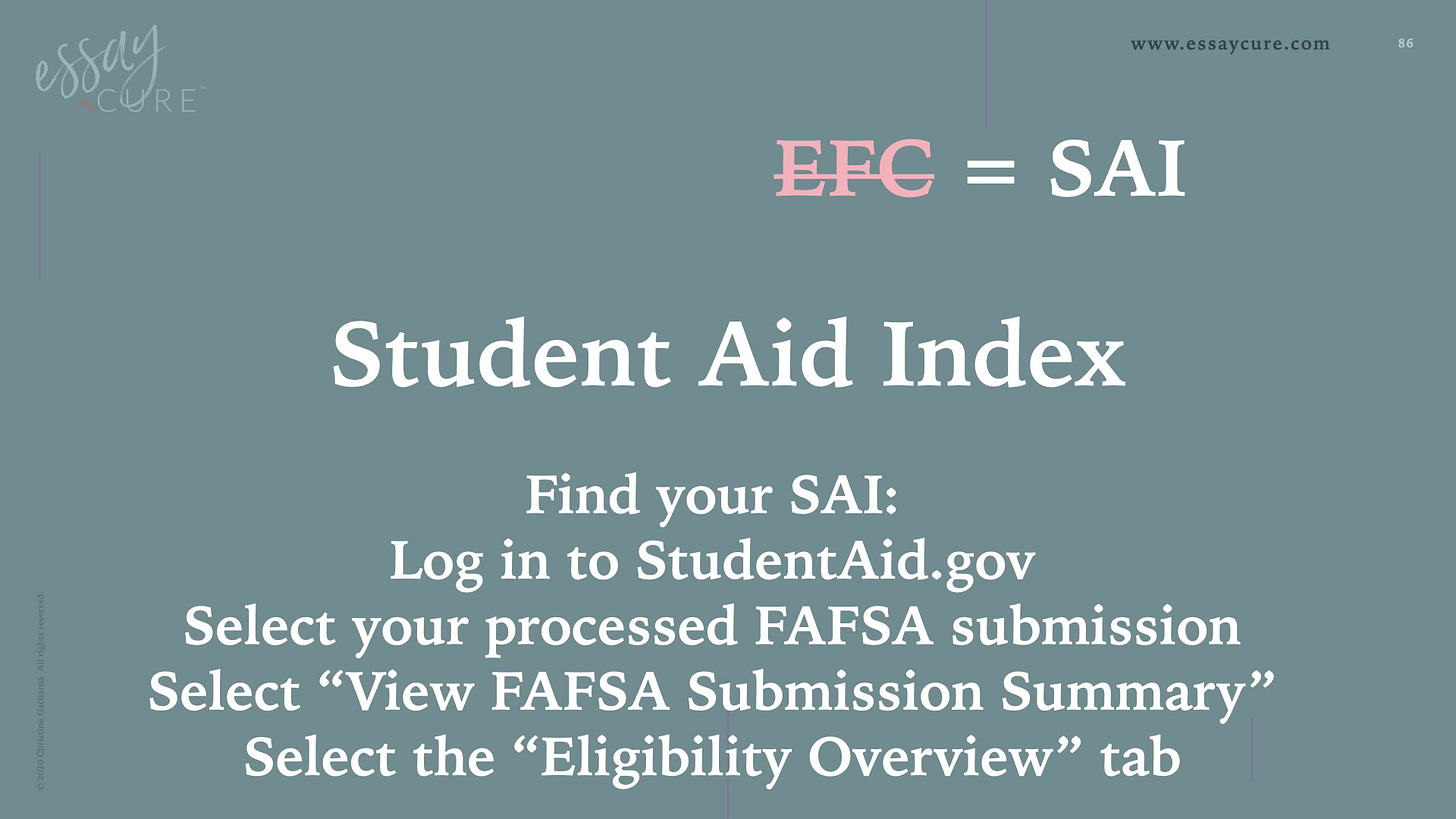

EFC stands for “Expected Family Contribution,” and we don't even use these words anymore.

The federal government takes the numbers from the FAFSA and spit out what they used to call the EFC, the “Expected Family Contribution.”

Words are powerful.

Parents were bristling at this “Expected Family Contribution” because how in the world am I expected to contribute an amount nearly equal to my annual salary?

The EFC was almost always an exorbitant number.

The federal government has since changed the wording to “Student Aid Index” or SAI, which I think softens the blow for parents (making parents less outraged at the government, although it doesn’t do much to soften the blow for shouldering the costs of higher education.)

SAI indicates what a student is going to need from a college in order to realistically afford tuition, and colleges are looking at this in conjunction with admission decisions.

This is how to find your SAI:

When students start looking at the numbers at the end of the process, the SAI factors heavily.

Every college has a net price calculator on their website; students can use their SAI and this net price calculator to get a fairly accurate picture of what it would cost them to attend a particular school.

FAFSA and CSS Profile

Q: What's the difference between the FAFSA and CSS Profile?

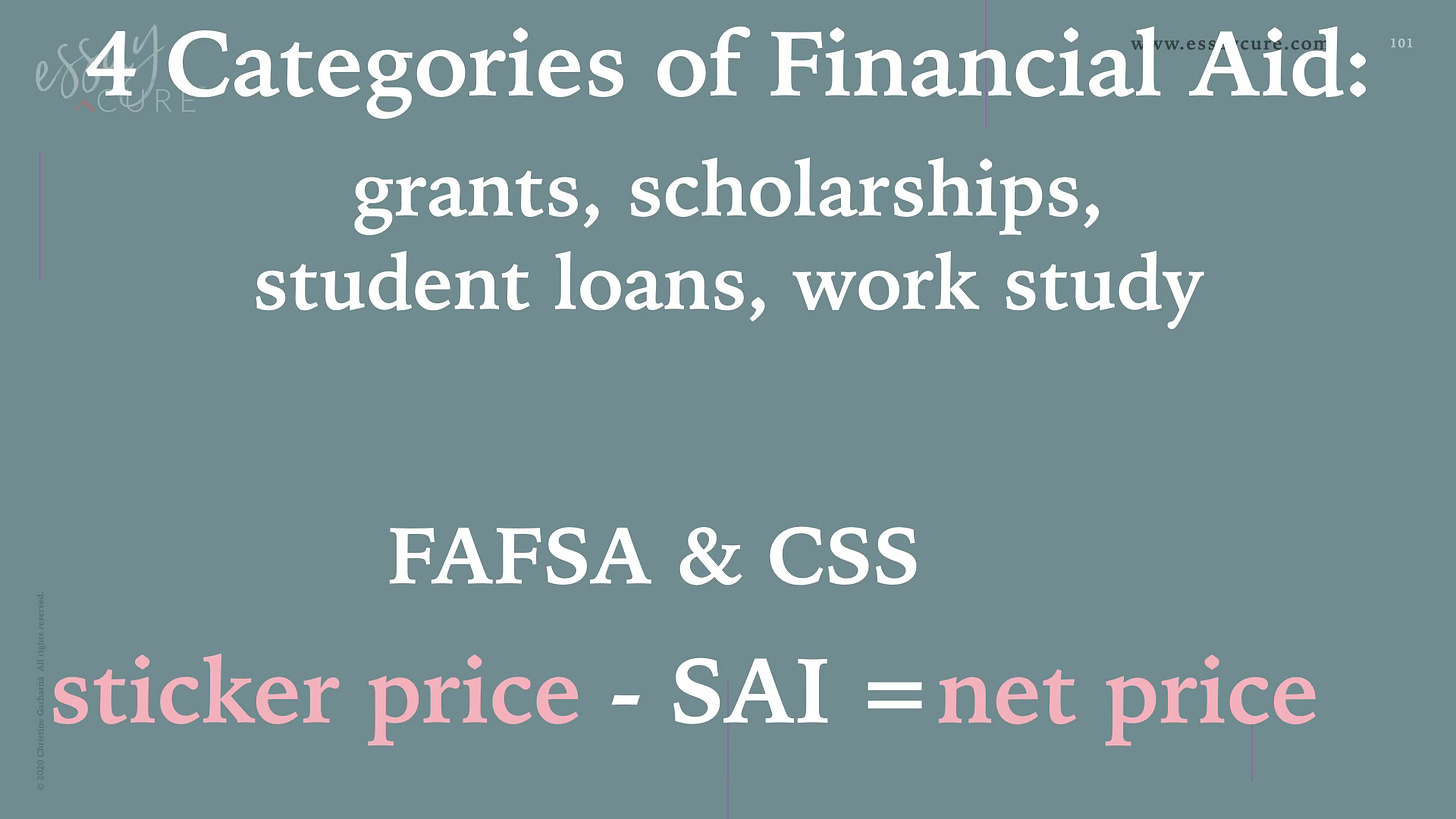

There are four categories of financial aid: grants, scholarships, student loans, and work study.

A: The FAFSA is the Free Application for Federal Student Aid. Think of the “F”s.

The FAFSA is free; websites that charge are commercial sites, not on the government website.

The CSS Profile unlocks more than 10 billion in non-federal aid. These are endowments, personal grants, and scholarships. I call them “OPM,” which is “other people's money,” the best way for students to go to college. 😜

There’s no such thing as handouts in this process. Nobody’s coming. Nobody is going to show up at your door and say, “Hey, can I give you a couple hundred thousand dollars to send your kid to college?” I never hear of that happening.

The underlying principle is that college costs money and students and parents are expected to bear the brunt of that responsibility.

“Need blind” schools don't consider a student's financial situation for admission.

Wait — does that mean that schools that aren't need blind do? Yes. That's exactly what that means.

Words are powerful. Let's start shifting our minds from financial aid, people giving us money, to paying for college. When students and parents are out shopping for colleges, they should be looking at what those colleges cost and weighing those numbers within the family budget.

College is a pay-to-play game. There’s not going to be any handouts. Parent PLUS? That’s a loan. That needs to be paid back.

I don't like to see students saddled with debt when they graduate from college. (See “Using The Rule of 72.”)

The difference between the sticker price of a college and the net price is the sticker price minus SAI. That’s what students can reasonably expect to pay.

Remember, every college has a net price calculator; before students apply, there should be frank conversations as a family as to whether or not this is a school the family budget can commit to paying for.